Rootfinding¶

- The Bible: the love of money is the root of all evil

- Mark Twain: the lack of money is the root of all evil

- Ayn Rand:money is the root of all good

Common rootfinding methods¶

Search the root of a scalar function $f(x) = 0$, common methods:

- Bisection

- Secant

- Newton-Ralphson

- Brent

Illustrative Examples:¶

- compute the implied volatility of a call option.

- a more challenging problem of $\Phi(x) + .05x - 0.5 = 0$

from scipy.stats import norm

lecture = 4

# black scholes call

def bs_call(r, s, k, sigma, t) :

d1 = (math.log(s/k) + (r + .5*sigma*sigma)*t)/sigma/math.sqrt(t)

d2 = d1 - sigma*math.sqrt(t)

return norm.cdf(d1)*s - norm.cdf(d2)*k*math.exp(-r*t)

# black scholes vega

def bs_vega(r, s, k, sigma, t) :

d1 = (math.log(s/k) + (r + .5*sigma*sigma)*t)/sigma/math.sqrt(t)

return math.sqrt(t)*s*norm.pdf(d1)

f = lambda s : bs_call(r=.05, s=100, k=150., sigma=s, t=1) - 1.

g = lambda s, foo, bar : bs_vega(r=.05, s=100, k=150., sigma=s, t=1)

f2 = lambda x : norm.cdf(x) + .05*x - .5

g2 = lambda x, a, b : norm.pdf(x) + .05

fig = figure(figsize=[12, 3.5])

subplot(1, 2, 1)

sigs = np.arange(.01, .5, .01)

bsv = np.array([f(s) for s in sigs])

plot(sigs, bsv, '-')

axhline(color = 'r');

xlabel('Volatility')

ylabel('Price');

title('Black Scholes Call')

subplot(1, 2, 2)

x2 = np.arange(-5, 5, .1)

plot(x2, f2(x2));

xlabel('$x$')

axhline(color = 'r');

xlim(-5, 5)

title('$\Phi(x) + .05x - 0.5 = 0$');

Bisection¶

- initial guess must bucket the solution: find $x\in [a,b]$ such that $f(x) = 0$, given

- $f(a)*f(b) \leq 0$

- the function must be continuous

- converges to a root linearly (absolute error halves for each iteration).

- $\epsilon_{n+1} \le c \epsilon_n^q, \;\epsilon_n = \left| x_n - x_{root}\right|,\; q=1, \;c=\frac{1}{2}$

import scipy.optimize as opt

a = .1

b = .45

def cumf (x, func, xs) :

xs.append(x)

return func(x)

xs = []

nx = opt.bisect(cumf, a, b, args=(f, xs))

def show_converge(f, xs, a, b, maxIter, tag, diagline = True, txty = .5) :

figure(figsize = [12, 3.5])

subplot(1, 2, 1)

xr = np.arange(a*.9, b*1.1, (b-a)/500.)

bsv = np.array(list(map(f, xr)))

plot(xr, bsv, '-')

axhline(color = 'k');

for i in range(maxIter) :

plot([xs[i], xs[i]], [0, f(xs[i])])

scatter(xs[i], txty*(1. if f(xs[i]) < 0 else -1.),

s=150, marker = "$%d$"% i)

if diagline and i< (maxIter-1):

plot([xs[i], xs[i+1]], [f(xs[i]), 0])

xlim(a*.9, b*1.1);

ylim(f(a) - .2, f(b) + .2);

xlabel('$x$')

ylabel('$f(x)$')

title(tag)

subplot(1, 2, 2)

es = np.abs(list(map(f, xs)))

semilogy(es, '.');

xlabel('Iterations')

title('Error');

show_converge(f, xs, .1, .45, 6, 'Bisection', False)

Secant¶

- Uses the secant line to find successive approximation

$$ x_n = x_{n-1} - f(x_{n-1})\frac{x_{n-1} - x_{n-2}}{f(x_{n-1}) - f(x_{n-2})} $$

- Converges faster than Bisection method with $\epsilon_{n+1} \le c\epsilon_n^q, \; q\approx 1.618 $

- Can be thought of as poor man's choice of the Newton's method --- also referred to as a quasi-Newton method.

xs = []

g = lambda s, foo, bar : bs_vega(r=.05, s=100, k=150., sigma=s, t=1)

nx = opt.newton(cumf, b, args=(f, xs))

show_converge(f, xs, 0.2, .45, 4, 'Secant', True)

- Secant method is not guaranteed to converge.

- Suffers for wiggly functions with small/vanishing derivative.

xs = []

try :

nx = opt.newton(cumf, 3, args=(f2, xs))

except RuntimeError:

pass

show_converge(f2, xs, -11, 11, 5, 'Secant', True, .1)

Newton-Ralphson¶

- Use first derivative to approximate the root

$$ x_n = x_{n-1} - \frac{f(x_{n-1})}{f'(x_{n-1})} $$

- converges quadratically: $\epsilon_{n+1} \le c\epsilon_n^q,\; q=2$.

xs = []

nx = opt.newton(cumf, b, g, args=(f, xs))

show_converge(f, xs, 0.2, .45, 3, 'Newton-Ralphson', True)

- convergence is not guaranteed, it can fail around inflection point

- guaranteed convergence if the function is convex everywhere.

xs = []

try :

nx = opt.newton(cumf, 2, g2, args=(f2, xs))

except RuntimeError:

pass

show_converge(f2, xs, -5, 9.5, 3, 'Newton-Ralphson', True, .1)

Brent¶

- An adaptive algorithm---mixes root bracketing, bisection and

- Inverse quadratic interpolation (Secant uses linear interpolation)

- Guaranteed to find a solution if initial guesses bucket the root

- Usually converges very fast $\epsilon_{n+1} \le c\epsilon_n^q, \; q \approx 1.839$.

- Often the default choice in practice

xs = []

g = lambda s, foo, bar : bs_vega(r=.05, s=100, k=150., sigma=s, t=1)

nx = opt.brentq(cumf, a, b, args=(f, xs))

show_converge(f, xs, 0.1, .45, 5, 'Brent', False)

The challenging $\Phi(x) + .05x - 0.5 = 0$ converges under Brent:

xs = []

nx = opt.brentq(cumf, -1, 4, args=(f2, xs))

show_converge(f2, xs, -1.5, 5, 5, 'Brent', True, .1)

Interpolation¶

interpolate: verb, insert (something) between fixed points

Common interpolation methods¶

From a discrete set of knot values $x_i, y_i$, find a function $f: x \rightarrow y$.

- that hits all the knot values

Common interpolation methods:

- Linear

- Polynomial

- Cubic spline

We will cover in detail:

- Tension spline

- Maximum entropy (if time permits)

Linear interpolation¶

x = np.array([.1, 1.,2, 3., 5., 10., 25.])

y = np.array([.0025, .01, .016,.02, .025, .030, .035])

plot(x, y, '-o');

xlabel('Year')

ylabel('Rates');

title('Linear Interpolation');

Piecewise constant interpolation¶

- values equals to the observation to the right (or left).

- simple (maybe even silly) but useful in curve building

- works well with bootstrap

m = dict(zip(x, y))

m.update(dict(zip(x[:-1] + 1e-6, y[1:])))

k, v = zip(*sorted(m.items()))

plot(k, v, 'o-')

title('Piecewise Constant');

Polynomial interpolation¶

- Fit a polynomial function of order $n-1$ to the $n$ observations.

- The exact solution is known as the Lagrange polynomials:

$$ p(x) = \sum_{i=0}^n(\prod_{1\le j \le n, j\ne i}\frac{x-x_j}{x_i-x_j})y_i $$

It is rarely used in practice because ...

z = np.polyfit(x, y, len(x)-1)

p = np.poly1d(z)

x1d = arange(0, 26, .1)

plot(x1d, p(x1d))

plot(x, y, 'o');

title('Polynomial');

Spline interpolation¶

Spline is an elastic string or pipe, used by draftsmen to draw smooth curves through fixed knots before the computer age:

|

|

Spline interpolation is a mathematical model for the physical spline.

Cubic spline¶

Cubic spline uses a 3rd order polynomial for each line section between knots

$$q_i(x) = a_i + b_i x + c_i x^2 + d_i x^3 \;,\;\; x_i < x < x_{i+1}$$

Enforce continuity up to the 2nd derivatives:

\begin{eqnarray} q_{i-1}(x_i) &=& q_{i}(x_i) \\ q'_{i-1}(x_i) &=& q'_{i}(x_i) \\ q''_{i-1}(x_i) &=& q''_{i}(x_i) \end{eqnarray}

Boundary conditions¶

For $n$ knots, there are $n-1$ line sections with $4(n-1)$ parameters

- $n$ constraint for the hitting the $n$ knot values

- 3 continuity constraints for each intermediate knot: $3(n-2)$

- $4n-6$ constraints in total

Two additional constraints required to uniquely determine the cubic spline:

- Natural Spline: $s''_1(x_1) = s''_{n-1}(x_{n}) = 0$

- End slope conditions: $s'_1(x_1) = c_0, s'_{n-1}(x_{n}) = c_1$

Cubic spline examples¶

Spline interpolation is very smooth

However, it does not preserve monotonicity and convexity

- it could overshoot

- can result in arbitrages in many situations

import lin

ts = lin.RationalTension(0.)

ts.build(x, y)

x2 = np.array([.01, .03, .07, .1, .6])

y2 = np.array([.0095, .023, .035, .040, .042])

figure(figsize=[12, 4])

subplot(1, 2, 1)

plot(x1d, ts.value(x1d))

plot(x, y, 'o');

title('Cubic Spline');

subplot(1, 2, 2)

ts.build(x2, y2)

x2d = arange(.01, .65, .01)

plot(x2d, ts.value(x2d))

plot(x2, y2, 'o');

xlabel('Detachement')

title('CDO Tranche Expected Loss');

Convexity¶

Option-like instruments' prices are convex functions:

$$ v(k) = \mathbb{E}[\max(\tilde s - k, 0)] $$

No arbitrage requires $\frac{\partial^2 v}{\partial k^2} > 0 $, because:

$$\small \frac{\partial^2}{\partial k^2}\mathbb{E}[\max(\tilde s-k, 0)] = \mathbb{E}[\frac{\partial^2}{\partial k^2} \max(\tilde s-k, 0)] = \mathbb{E}[\delta(\tilde s-k)] = p(k) $$

- $\delta(x)$ is the Dirac delta function: $\int_{-\infty}^{\infty} f(x) \delta(x-a) dx = f(a)$

- $p(\cdot)$ is the probability density function of $\tilde s$

- The expected loss of a 0 to $k$ tranche is concave because:

- $v(k) = \mathbb{E}[\min(\tilde l, k)] = k - \mathbb{E}[\max(k-\tilde l, 0)]$

Exponential tension spline¶

A tension spline is originally defined as: $f^{(4)}(x) - \lambda f''(x) = 0$

- it models a physical spline stretched by a tension force

- $\lambda$ is the ratio of the tension force over the rigidity of the spline

- it reduces to cubic spline when $\lambda = 0$

- with $\lambda \rightarrow \infty$, the spline is stretched to piece-wise straight lines

- the solution is a combination of exponential and linear functions of $x$

Rational tension spline¶

Generic tension spline has the following property:

- has a scalar tension parameter $\lambda$

- when $\lambda = 0$, it reduces to cubic spline

- it converges to piecewise linear interpolation uniformly as $\lambda$ increases

Rational tension spline is a convenient form of generic tension spline:

import fmt

a, b, c, d, t = sp.symbols('a b c d t', real = True)

l = sp.symbols('lambda', positive=True)

f = sp.Function('f')

df = sp.Function("\dot{f}")

ddf = sp.Function("\ddot{f}")

r = (a + b*t + c*t**2 + d*t**3)/(1 + l*t*(1-t))

s_x, xi, xii, xi_ = sp.symbols('x, x_i, x_{i+1}, x_{i-1}', real=True)

fmt.displayMath(fmt.joinMath('=', f(t), r), fmt.joinMath('=', t, (s_x-xi)/(xii-xi)))

- it is more tractable than the exponential tension spline as only polynomial functions are involved

- solvable the same way as cubic spline, $\lambda$ is a known parameter

Constraints¶

The rationale tension spline's values and derivatives at $t=0$ and $t=1$:

from fmt import math2df

pd.options.display.max_colwidth=300

def lincollect(e, tms) :

m = sp.collect(sp.expand(e), tms, evaluate=False)

return [m[k] if k in m else 0 for k in tms]

coefs = sp.Matrix([a, b, c, d])

drt0 = sp.Matrix([lincollect(r.diff(t, i).subs({t:0}), coefs) for i in range(3)])

drt1 = sp.Matrix([lincollect(r.diff(t, i).subs({t:1}), coefs) for i in range(3)])

derivs = sp.Matrix([f(t), df(t), ddf(t)])

fmt.displayMath(fmt.joinMath('=', derivs.subs({t:0}), drt0), coefs, sep="", pre="\\scriptsize")

fmt.displayMath(fmt.joinMath('=', derivs.subs({t:1}), drt1), coefs, sep="", pre="\\scriptsize")

- Note the short-handed notation of $\ddot{f}(1) = \frac{d^2f(t)}{d t^2} \rvert _{t=1}$ etc.

- $\lambda$ is a known constant

- Like cubic spline, there are $4(n-1)$ variables and constraints

- Solvable as a $4(n-1)$ dimensional linear systems ~ $O((4n)^3)$

A better solution¶

Consider one line section between $[x_i, x_{i+1}]$:

- the four coefficients are fully determined by $f(0)$, $f(1)$, $\ddot{f}(0)$, $\ddot{f}(1)$:

s_v = sp.Matrix([f(0), f(1), ddf(0), ddf(1)])

s_a = sp.Matrix([drt0[0, :], drt1[0, :], drt0[2, :], drt1[2, :]])

fmt.displayMath(s_a, fmt.joinMath('=', coefs, s_v), sep="", pre="\\scriptsize")

The linear system can be explicitly inverted (by sympy!):

ss = sp.simplify(sp.expand(s_a.inv()))

fmt.displayMath(fmt.joinMath('=', coefs, ss), s_v, sep="\\scriptsize")

- the resulting $a, b, c, d$ ensures that the rational tension spline hits the target $f(t), \ddot{f}(t)$ at both ends of the line section.

- $\dot{f}(x_i)$ becomes linear combinations of $f$ and $\ddot f$ for line sections $[x_{i-1}, x_i]$ or $[x_i, x_{i+1}]$

- the $\dot{f}(x_i)$ from the left and right line sections must equal

Continuity conditions¶

Thus $\ddot{f}(x_i)$ at the knots are the only $n$ unknowns, which are solvable from the following $n$ constraints:

- End condition (natural spline): $\ddot{f}(x_1) = \ddot{f}(x_{n}) = 0$

- Continuity in $\dot{f}(x_i)$ for $n-2$ intermediate knots

Note that $f(\cdot)$ and its derivatives are continuous in $x$, not $t$:

$$ \frac{d^k f(t)}{dt^k} = (x_{i+1}-x_i)^k\frac{d^k f(x)}{dx^k} $$

- this is because $t = \frac{x-x_i}{x_{i+1} - x_i}$

- what if end conditions are given in $\dot{f}(x_1)$ and $\dot{f}(x_{n})$?

Continuity in $f'(x_i)$¶

xl, xr = sp.symbols('x_l, x_r')

vm = {xl:(xi-xi_), xr:(xii-xi)}

sl = sp.Matrix([f(xi_), f(xi), ddf(xi_)*xl**2, ddf(xi)*xl**2])

sr = sp.Matrix([f(xi), f(xii), ddf(xi)*xr**2, ddf(xii)*xr**2])

dl = sp.simplify(sp.expand((drt1[1,:]*ss*sl/xl)[0,0]))

dr = sp.simplify(sp.expand((drt0[1,:]*ss*sr/xr)[0,0]))

terms = sp.Matrix([ddf(xi_), ddf(xi), ddf(xii)])

d1 = sp.collect(sp.expand(dl - dr), terms, evaluate=False)

mr = sp.Matrix([sp.simplify(sp.simplify(d1[k]).subs(vm)) for k in terms])

rhs = sp.simplify(-d1[sp.S.One]).subs(vm)

fmt.displayMath(mr.T, terms, sep="")

fmt.displayMath("\;\;\;\;\;\;\; =", rhs, sep="")

#displayMath(*[fmt.joinMath('=', k, v) for k, v in vm.items()])

- this linear system can be written as a tri-diagonal matrix

Tri-diagonal system¶

The following is the linear system of the 1st interpolation example with $\lambda = 2$:

import trid

ts3 = trid.TridiagTension(2.)

ts3.build(x, y)

fmt.displayMath(sp.Matrix(np.round(ts3.a, 3)), fmt.joinMath('=', "\\boldsymbol{\\ddot{f}}", #ddf(s_x),

sp.Matrix(np.round(ts3.b, 4))), sep="", pre="\\small")

Thomas algorithm:

- a sparse version of the LU decomposition

- solves the tri-diagonal system in $O(n)$ operations

What is the complexity of regular LU decomposition?

Tension spline examples¶

def plotTension(x, y, lbds, xd) :

plot(x, y, 'o');

title('Tension Spline');

for lbd in lbds:

ts = lin.RationalTension(lbd)

ts.build(x, y)

plot(xd, ts.value(xd))

legend(['data'] + ['$\lambda = %.f$' % l for l in lbds], loc='best');

lbds = (0, 2, 10, 50)

figure(figsize=[12, 4])

subplot(1, 2, 1)

plotTension(x, y, lbds, x1d)

subplot(1, 2, 2)

plotTension(x2, y2, lbds, x2d)

- converges to piece wise flat curve uniformly with increasing $\lambda$

Perturbation locality¶

Spline interpolation is global:

- changing a single knot affects the whole curve

- the perturbation is more localized with greater tension parameter $\lambda$

def plotPerturb(x, y, yp, xd, lbds) :

plot(x, yp-y, 'o')

for lbd in lbds:

ts = lin.RationalTension(lbd)

ts.build(x, y)

tsp = lin.RationalTension(lbd)

tsp.build(x, yp)

plot(xd, tsp.value(xd) - ts.value(xd))

xlabel('$x$')

ylabel('$y$')

title('Changes in Spline')

legend(['knots'] + ['$\lambda = %.f$' % l for l in lbds], loc='best');

dy = .01

figure(figsize=[12, 4])

subplot(1, 2, 1)

idx = 3

yp = np.copy(y)

yp[idx] *= 1. + dy

plotPerturb(x, y, yp, x1d, lbds)

subplot(1, 2, 2)

idx = 1

yp = np.copy(y2)

yp[idx] *= 1. + dy

plotPerturb(x2, y2, yp, x2d, lbds)

Integral of tension spline¶

- Though complicated, the integral is analytical nonetheless

- The integral can be useful in deriving analytical pricing formulae

- derived using

sympy

- derived using

s_s0, s_s1, s_s2, s_c1, s_c2, s_com = sp.symbols('s_0, s_1, s_2, c_1, c_2, c_0')

short = sp.simplify(sp.Rational(1, 2)/l/s_com*(s_s0 + s_s1*(s_c1 + s_c2) + s_s2*(s_c1 - s_c2)))

fmt.displayMath(fmt.joinMath('=', sp.Integral(r, (t, 0, tt)), short), pre="\\scriptsize ")

com = sp.sqrt(l*(l+4))

s0 = -d*tt**2*s_com - 2*tt*(c+d)*s_com

s1 = sp.log((sp.sqrt(l+4)+sp.sqrt(l))/(sp.sqrt(l+4)+sp.sqrt(l)-2*sp.sqrt(l)*tt))

s2 = sp.log((sp.sqrt(l+4)-sp.sqrt(l))/(sp.sqrt(l+4)-sp.sqrt(l)+2*sp.sqrt(l)*tt))

c1 = d*s_com/l + s_com*(b+c+d)

c2 = l*(2*a+b+c+d)+(2*c+3*d)

#short = sp.simplify(sp.Rational(1, 2)/l/com*(s0 + s1*(c1 + c2) + s2*(c1 - c2))).subs({s_com:com})

fmt.displayMath(fmt.joinMath('=', s_com, com), fmt.joinMath('=', s_s0, s0), pre="\\scriptsize ")

fmt.displayMath(fmt.joinMath('=', s_s1, s1), fmt.joinMath('=', s_s2, s2), pre="\\scriptsize ")

fmt.displayMath(fmt.joinMath('=', s_c1, c1), fmt.joinMath('=', s_c2, c2), pre="\\scriptsize ")

Curve Building in Finance¶

In life, as in art, the beautiful moves in curves.

Curve building fundamentals¶

- Inputs: prices of benchmark instruments of the same risk factor, at different maturities

- Outputs: a single curve for the underlying factor that explains all observed prices to adequate precision.

- Curve building is a fundamental problem in Finance, it can become extremely complicated

Common types of curves¶

- Interest rate: OIS, Libor 3M/6M etc,

- CDS (credit default swap)

- Commodity

- FX

- Inflation

Curve terminology¶

$b(t)$ is the price of risk free zero coupon bond maturing at $t$:

- Zero rate (or spot rate, yield, internal rate of return):

$$r(t) = -\frac{1}{t}\log(b(t)) \iff b(t) = e^{-r(t) t} $$

- Forward rate:

$$f(t) = -\frac{1}{b(t)}\frac{d b(t)}{d t} \iff b(t) = e^{-\int_{0}^t f(s) ds} $$

- Swap rate (continuous coupon):

$$s(t) = \frac{1 - b(t)}{\int_0^t b(s) ds} \iff s(t) \int_0^t b(s) ds + b(t) = 1 $$

Relationship between rates¶

dt = .1

t = np.arange(dt, 30, dt)

tn = np.array([0, 5, 30])

rn = np.array([.04, .06, .055])

cv = lin.RationalTension(2.)

cv.build(tn, rn)

f = cv(t) + t*cv.deriv(t)

b = exp(-t*cv(t))

intb = np.cumsum(b*dt)

s = (1-b)/intb

plot(t, cv(t));

plot(t, f)

plot(t, s)

legend(['Zero Rate', 'Forward Rate', 'Swap Rate'], loc='best');

xlabel('Time');

- zero rate is the average of forward rate:

$$ r(t) = \frac{1}{t} \int_0^t f(s) ds $$

- zero rate is an approximation to the swap rate (when $b(t) \approx 1$):

$$ s(t) = \frac{1 - b(t)}{\int_0^t b(s) ds} \approx \frac{1 - e^{-r(t)t}}{t} \approx \frac{r(t) t}{t} = r(t) $$

Introduction to CDS¶

| No Default | With Default |

|---|---|

|

|

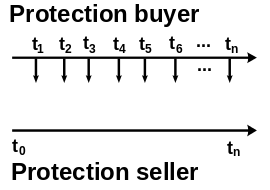

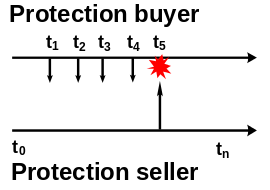

CDS is an insurance against a reference entity's default risk

- protection buyer: makes quarterly payments of notional$\times$spread$\times$daycount.

- protection seller: pays the default loss of notional$\times$(1-rec) when the reference entity defaults before CDS maturity.

Long or short ?¶

Important market convention: long position is always equivalent to owning the underlying bond

- receiver swap is long $\iff$ own a fixed coupon risk free bond

- sell CDS protection is long $\iff$ own a fixed coupon risky bond

Deltas are always communicated by perturbing the market to the longer side, i.e., the direction where long positions makes money:

- interest rate decrease by 1bps

- credit spread compress by 1bps

- positive deltas always corresponds to long positions

Often the risk computation is done by bumping rates +1bps, then flipping the signs before the final reporting.

IR vs credit terminologies¶

In a very loose way, the following terms are the counterparts between IR and credit/CDS market (all in continuous compounding):

| Interest Rate | Credit | |

|---|---|---|

| primary state variable | discount factor $b(t)$ | survival probability $p(t)$ |

| yield, IRR | zero rate $r(t) = -\frac{1}{t}\log(b(t))$ |

quoted spread $q(t) \approx -\frac{1 - \text{rec}}{t}\log(p(t))$ |

| forward rate | forward interest rate $f(t) = -\frac{1}{b(t)}\frac{d b(t)}{d t} $ |

hazard rate $h(t) = -\frac{1}{p(t)}\frac{d p(t)}{d t} $ |

| par swap rate $s(t)$ | par IR swap rate | par CDS spread |

| cumulative yield | $y(t) = -\log(b(t))$ | $g(t) = -\log(p(t)) $ |

CDS benchmark instruments¶

The following is a representative set of CDS quotes observed in the market:

import inst

def flatCurve(rate) :

return lambda t : np.exp(-rate*t)

disc = flatCurve(.01)

terms = np.array([.25, .5, 1., 2, 3, 4, 5, 6, 7, 8, 10])

qs = np.array([80, 85, 95, 154, 222, 300, 385, 410, 451, 470, 480])

cps = np.ones(len(terms))*100

insts = [inst.CDS(m, c*1e-4, .4) for m, c in zip(terms, cps)]

#compute the upfront PV of the benchmark instruments

ufr = np.array([i.pv01(disc, flatCurve(f*1e-4))*(c-f)*1e-4 for i, f, c in zip(insts, qs, cps)])

mat_tag = 'Maturity (Y)'

pd.set_option('precision', 4)

cds_data = pd.DataFrame({mat_tag:terms, 'Coupon(bps)':cps, 'Quoted Spread(bps)':qs, 'PV (% Points)': ufr*100.}).set_index(mat_tag)

fmt.displayDF(cds_data.T, "4g", fontsize=2)

benchmarks = dict(zip(insts, ufr))

| Maturity (Y) | 0.25 | 0.5 | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | 6.0 | 7.0 | 8.0 | 10.0 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coupon(bps) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Quoted Spread(bps) | 80 | 85 | 95 | 154 | 222 | 300 | 385 | 410 | 451 | 470 | 480 |

| PV (% Points) | 0.04978 | 0.07448 | 0.0494 | -1.05 | -3.475 | -7.356 | -12.58 | -15.92 | -20.25 | -23.6 | -28.63 |

- the CDS contract have standardised semi-annual maturities, on Mar-20 and Sep-20

- it usually costs more per annum for longer term contracts

- for most names, there are only a few liquid CDS instruments, referred as the benchmark instruments

- quoted spreads is a way to communicate the upfront payment, it loosely corresponds to the zero rate or yield in IR

What to interpolate?¶

It is important to choose the right quantity to interpolate

- There are many potential choices, e..g: $f(t), f'(t)$ or $\int_0^t f(s) ds$ etc.

- Which variable is a natural fit for tension spline's stretch operation?

- We want the variable itself to be continuous, but can live with the discontinuities in $f'(t)$ when $\lambda \rightarrow \infty$

Industry standard: $$p(t) = e^{-\int_0^t h(s) ds}$$

- build piecewise flat curve in hazard rate $h(t)$ for CDS:

- where $p(t)$ is the survival probability of the reference entity at time $t$.

this is quite odd, why don't we use a continuous interpolation in $h(t)$?

- such as piece wise linear or cubic spline?

Triangular dependency¶

The objective:

- build a curve in hazard rate $\bs h(t)$ that exactly reproduce all observed CDS prices quoted in $\bs q(t)$

| $h(3m)$ | $h(6m)$ | $h(1Y)$ | $h(2Y)$ | $h(5Y)$ | |

|---|---|---|---|---|---|

| $q(3m)$ | X | ||||

| $q(6m)$ | * | X | |||

| $q(1Y)$ | * | * | X | ||

| $q(2Y)$ | * | * | * | X | |

| $q(5Y)$ | * | * | * | * | X |

Bootstrap is the standard method to build curves with triangular dependency:

- Solve the knot values one by one, using benchmark instruments with increasing maturities

Piecewise flat bootstrap¶

- This is the standard approach to build CDS curves in the industry

- $g(t)$ is the cumulative hazard: $g(t) = \int_0^t h(s) ds = -\log(p(t))$

- Piecewise flat in hazard rate $h(t)$ is equivalent to piecewise linear in $g(t)$

cdspv = inst.cdspv(disc, inst.zero2disc)

hlin = lin.PiecewiseLinear()

hlin.build(terms, terms*.01)

hlin.addKnot(0, 0)

hlin = inst.bootstrap(benchmarks, hlin, cdspv, bds = [-1., 1.])

cds_data['PV Error (bps) - Linear'] = np.round([1e4*(cdspv(i, hlin) - benchmarks[i]) for i in insts], 4)

xs = np.arange(.01, 10, .01)

figure(figsize=[12, 4])

subplot(1, 2, 1)

plot(xs, hlin(xs))

plot(terms, hlin(terms), 'o')

xlabel('Time')

title('$g(t)$');

subplot(1, 2, 2)

plot(xs, hlin.deriv(xs))

plot(terms, hlin.deriv(terms-1e-4), 'o')

xlabel('Time')

title('$h(t)$');

Pros and cons of piecewise flat bootstrap¶

- All benchmark prices are exactly matched, after bootstrap with piecewise flat hazard rate.

- Discontinuity in hazard rate causes hedging problems, risk profiles jump over the roll dates.

fmt.displayDF(cds_data.T, "4g", fontsize=2)

| Maturity (Y) | 0.25 | 0.5 | 1.0 | 2.0 | 3.0 | 4.0 | 5.0 | 6.0 | 7.0 | 8.0 | 10.0 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Coupon(bps) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| Quoted Spread(bps) | 80 | 85 | 95 | 154 | 222 | 300 | 385 | 410 | 451 | 470 | 480 |

| PV (% Points) | 0.04978 | 0.07448 | 0.0494 | -1.05 | -3.475 | -7.356 | -12.58 | -15.92 | -20.25 | -23.6 | -28.63 |

| PV Error (bps) - Linear | -0 | -0 | -0 | -0 | -0 | -0 | 0 | 0 | -0 | -0 | -0 |

How to remove the discontinuity in hazard rate?

- applying cubic spline to hazard rate seems to be a natural idea, does it work?

Cumulative hazard¶

The cumulative hazard $g(t)$ is a suitable variable for the tension spline interpolation:

$$g(t) = \int_0^t h(s) ds = -\log(p(t))$$

- $g(t)$ is continuous and monotonic, 1 to 1 with $p(t)$

- $g(0) = 0$, the boundary condition is well defined

- $h(t) = g'(t)$ can be discontinuous when $\lambda \rightarrow \infty$, this reverts to the standard method of piecewise flat hazard rate

- with finite $\lambda$, hazard rate is smooth and continuous

This argument carries over to the interest rate curve building:

- the cumulative yield, $y(t) = -\log(b(t))$, is a suitable variable to apply tension spline

Bootstrap with tension spline¶

def plotboot(tsit, lbd, ax, tagsf) :

xlabel('Time')

lbd_tag = '$\\lambda=%.f$' % lbd

df = pd.DataFrame({'$t$':xs}).set_index(['$t$'])

for tag, f in tagsf :

df[tag] = f(tsit, xs)

df.plot(ax = ax, secondary_y = [tagsf[0][0]], title = 'Tension Spline ' + lbd_tag)

plot(terms, tsit(terms), 'o')

tagsf = [("$g(t)$", lambda cv, xs : cv(xs)), ("$h(t)$", lambda cv, xs : cv.deriv(xs))]

lbds = [0, 2, 10, 100]

fig, axes = plt.subplots(nrows=2, ncols=2, figsize=[12, 8])

es = []

for lbd, ax in zip(lbds, axes.flatten()) :

tsit, e = inst.iterboot(benchmarks, cdspv, lbd=lbd, x0=0, its=1)

plotboot(tsit, lbd, ax, tagsf)

es.append(e[0])

Bootstrapping with global interpolation¶

The benchmark CDS won't reprice exactly after the bootstrapping with tension spline:

- Changes in longer maturity affects the shorter end of the curve

- The dependency matrix is no longer triangular, but close

df = pd.DataFrame(np.array(es)*1e4, index=['Fit Error (bps) $\\lambda$=%g' % l for l in lbds],

columns = ['%gY' % t for t in terms])

fmt.displayDF(df, "4f", fontsize=2)

| 0.25Y | 0.5Y | 1Y | 2Y | 3Y | 4Y | 5Y | 6Y | 7Y | 8Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Fit Error (bps) $\lambda$=0 | -0.0000 | -0.0000 | 0.0352 | 0.7148 | 1.1093 | 1.9968 | 2.1802 | 2.6090 | 2.5612 | 0.8231 | 0.0000 |

| Fit Error (bps) $\lambda$=2 | -0.0000 | -0.0000 | 0.0232 | 0.4637 | 0.7908 | 1.2876 | 1.4579 | 1.7260 | 1.7838 | 0.6388 | 0.0000 |

| Fit Error (bps) $\lambda$=10 | -0.0000 | -0.0000 | 0.0098 | 0.2026 | 0.3602 | 0.5634 | 0.6458 | 0.7598 | 0.8039 | 0.3038 | -0.0000 |

| Fit Error (bps) $\lambda$=100 | -0.0000 | -0.0000 | 0.0013 | 0.0281 | 0.0507 | 0.0782 | 0.0900 | 0.1057 | 0.1128 | 0.0435 | 0.0000 |

Recall how we force matrix to be triangular using QR algorithm?

Iterative algorithm¶

Iteration is an effective method for near triangular dependency:

$$\bs x^{i+1} = f(\bs x^i)$$

- where $f(\cdot)$ represent the bootstrap operation, $\bs x^i$ is knot solutions

- $\bs x^0$ is a initial guess, e.g. a flat curve

- simple and effective, usually outperforms sophisticated optimizers

Iteration with mixing¶

Mixing the old and new results between iterations improves stability:

$$\bs x^{i+1} = m f(\bs x^i) + \left(1-m\right) \bs x^i$$

- $m = 0.5$ is often a good choice

figure(figsize=[12, 4])

ax = subplot(1, 2, 1)

tsit, e = inst.iterboot(benchmarks, cdspv, x0=0, lbd = lbds[0], its=6)

tsit1, e1 = inst.iterboot(benchmarks, cdspv, x0=0, lbd = lbds[0], mixf=0.5, its=6)

plotboot(tsit, lbds[0], ax, tagsf)

subplot(1, 2, 2)

semilogy(range(1, len(e)+1), np.transpose([np.linalg.norm(e, 2, 1)*1e4, np.linalg.norm(e1, 2, 1)*1e4]), 'o-')

legend(['no mixing $m=0$', 'mixing $m=0.5$'], loc='best')

xlabel('Iteration')

ylabel('bps')

title('L-2 norm of error (bps)');

Effects of tension parameter $\lambda$¶

- No visible difference in $g(t)$

- Big difference in the hazard rate $h(t)$

- the smaller $\lambda$, the smoother the $h(t)$

def pv_lbds(bms, cdspv, lbds, x0) :

cvs = []

for lbd in lbds:

cv, e = inst.iterboot(bms, cdspv, x0, lbd, mixf = 0.5)

cvs.append(cv)

return cvs

lbds = (0, 2, 10, 50)

tags = ['$\\lambda=%.f$' % l for l in lbds]

cv0 = pv_lbds(benchmarks, cdspv, lbds, 0)

figure(figsize=[12, 4])

subplot(1, 2, 1)

plot(xs, np.array([cv(xs) for cv in cv0]).T);

title('$g(t)$')

xlabel('$t$')

subplot(1, 2, 2)

plot(xs, np.array([cv.deriv(xs) for cv in cv0]).T);

legend(tags, loc='best');

title('$h(t)$');

xlabel('$t$');

Perturbation locality¶

Changes in hazard rates are more localized with larger $\lambda$

- A highly desirable property in practice

def showPerts(bms, bms_ps, cdspv, lbds, x0, pertf) :

cv0 = pv_lbds(bms, cdspv, lbds, x0=x0)

cvp1, cvp2 = [pv_lbds(b, cdspv, lbds, x0=x0) for b in bms_ps]

lbd_tags = ['$\\lambda=%.f$' % lbd for lbd in lbds]

figure(figsize=[12, 4])

subplot(1, 2, 1)

plot(xs, 1e4*np.array([pertf(f, g)(xs) for f, g in zip(cv0, cvp1)]).T);

xlabel('Tenor')

ylabel('$\Delta h(t)$ (bps)')

title('1bps Spread Perturbation @t=%.2f' % pts[0])

legend(lbd_tags, loc='best');

plot(terms, 1e4*np.array([pertf(f, g)(terms) for f, g in zip(cv0, cvp1)]).T, '.');

subplot(1, 2, 2)

plot(xs, 1e4*np.array([pertf(f, g)(xs) for f, g in zip(cv0, cvp2)]).T);

xlabel('Tenor')

ylabel('$\Delta h(t)$ (bps)')

title('1bps Spread Perturbation @t=%.2f' % pts[1])

legend(lbd_tags, loc='best');

plot(terms, 1e4*np.array([pertf(f, g)(terms) for f, g in zip(cv0, cvp2)]).T, '.');

pts = [.5, 5]

bms_ps = [{k if k.maturity != pt else inst.CDS(k.maturity, k.coupon-1e-4, k.recovery) : v

for k, v in benchmarks.items()} for pt in pts]

showPerts(benchmarks, bms_ps, cdspv, lbds, 0, lambda f, g : lambda xs : f.deriv(xs) - g.deriv(xs))

Interpolate the hazard rate?¶

The result is disastrous:

- When $\lambda \rightarrow \infty$, it approaches linear interpolation in the hazard rate

- Linearly interpolating $h(t)$ leads to zigs and zags

hazard_pv = inst.cdspv(disc, inst.fwd2disc)

x0 = .01

chartf = [('$h(t)$', lambda cv, xs : cv(xs)), ('H(t)', lambda cv, xs : cv.integral(xs))]

fig, axes = plt.subplots(nrows=1, ncols=2, figsize=[12, 4])

lbds = (0, 20)

tsit0, e0 = inst.iterboot(benchmarks, hazard_pv, x0, lbds[0], mixf=.5)

plotboot(tsit0, lbds[0], axes[0], chartf)

tsit1, e1 = inst.iterboot(benchmarks, hazard_pv, x0, lbds[1], mixf=.5)

plotboot(tsit1, lbds[1], axes[1], chartf)

Perturbation in a single tenor generates waves throughout the hazard rate term structure.

showPerts(benchmarks, bms_ps, hazard_pv, lbds, x0, lambda f, g : lambda xs : f(xs) - g(xs))

State variable¶

Generally, it is always better to interpolate the state variable:

- state variable is the primary determinant of the benchmark price, such as the cumulative hazard $g(t) = -\log(p(t))$

- the derivatives, like $h(t) = g'(t)$, only changes the prices through its cumulative effects (integral), which leads to zigzags and waves when combined with a continuous interpolation.

bootstrap derivative variables + continuous interpolation = DISASTER

Assignments¶

Recommended reading:

Bindel and Goodman: Chapter 6.1, 6.2, 7.1

Andersen and Piterbarg: Chapter 6.1-6.2, 6.A

Homework:

- Complete homework set 4